Why the Japanese Salary System Seems Complex?

If you are considering a career as a software or mechanical engineer in Japan, you might find the job offers a bit confusing. Unlike many Western countries, where "Annual Base Salary" is the only figure that matters, Japan uses a unique structure composed of monthly base pay, seasonal bonuses, and various allowances.

Understanding this system is crucial not just for your survival, but for negotiating a package that reflects your true worth in one of the world's most advanced tech hubs.

What you will learn from this article:

- The difference between gross salary and "take-home" pay in Japan.

- How the Japanese bonus system and "Minashi Zangyo" (fixed overtime) work.

- How to maximize your career value as a foreign engineer using GTalent/GitTap.

Contents

- 1 Gross Salary vs. Net Salary (Take-home Pay)

- 2 The Japanese Bonus System (Seasonal Bonuses)

- 3 Understanding "Minashi Zangyo" (Fixed Overtime Pay)

- 4 Allowances: Housing, Commuting, and More

- 5 Reading Your Japanese Pay Slip (Kyuyo Meisai)

- 6 How to Ensure a Fair Salary Package

- 7 Essential Tools for Your Job Search

- 8 Conclusion

Gross Salary vs. Net Salary (Take-home Pay)

In Japan, your "Gross Salary" (Gakumen) and "Net Salary" (Te-dori) are different. Typically, your take-home pay is about 75% to 85% of your gross monthly salary.

What is deducted?

- Social Insurance (Shakai Hoken): This includes health insurance, welfare pensions, and unemployment insurance.

- Income Tax (Shotoku-zei): Calculated based on your monthly income.

- Residence Tax (Jumin-zei): Note that this is usually deducted from your second year in Japan onwards.

Source: National Tax Agency - "Taxes in Japan"

The Japanese Bonus System (Seasonal Bonuses)

Many Japanese companies, including large-scale manufacturers and traditional tech firms, offer bonuses twice a year (Summer and Winter).

Monthly Salary vs. Annual Salary: If a job offer states "Annual Salary: 6 Million JPY," it may include bonuses equivalent to 2–4 months of the base salary. The "13th Month Pay" Concept: While not legally mandated, many companies treat bonuses as a significant part of the total compensation. |

Pro-tip for Engineers: International tech startups in Tokyo often offer a "Total Annual Package" without bonuses, providing a higher monthly cash flow. Knowing which structure fits your lifestyle is key.

Understanding "Minashi Zangyo" (Fixed Overtime Pay)

One of the most unique aspects of the Japanese salary slip is Fixed Overtime Pay (Minashi Zangyo).

The Meaning: The company includes a set number of overtime hours (usually 20–45 hours) into your base monthly salary. The Benefit: Even if you work zero overtime hours, you still receive the full amount. The Catch: If you work more than the fixed hours, the company must pay the difference. |

For high-performing developers who work efficiently, this can effectively increase your hourly rate.

Allowances: Housing, Commuting, and More

Japanese companies often provide "Allowances" (Teate) that are separate from your base salary:

- Commuting Allowance: Most companies cover 100% of your train/bus commuting costs (usually up to 50,000 JPY/month). This is tax-free for the employee.

- Housing Allowance: Some companies provide a stipend to help with Tokyo’s rent, though this is becoming less common in pure "Foreign Capital" (Gaishikei) firms.

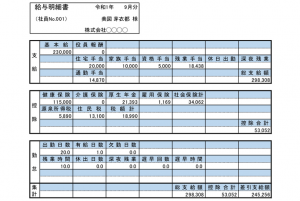

Reading Your Japanese Pay Slip (Kyuyo Meisai)

When you receive your first pay slip, look for these key terms:

- Kihon-kyu (基本給): Base salary.

- Teate (手当): Allowances.

- Kojo (控除): Deductions (Taxes and Insurance).

- Sashihiki Shikyugaku (差引支給額): The final amount deposited into your bank account.

How to Ensure a Fair Salary Package

As a foreign engineer, navigating these terms during an interview can be daunting. Are you being offered a fair rate for your Java or Robotics expertise?

The most effective way to secure a high-paying role is through a specialized recruitment agent. At GTalent, we specialize in connecting international IT and mechanical engineers with top-tier companies in Japan. We don't just find you a job; we negotiate your "Minashi Zangyo," sign-on bonuses, and relocation packages on your behalf.

Don't leave your salary to chance.

> Register with GTalent to access English-friendly, high-salary positions in Japan

Essential Tools for Your Job Search

To succeed in the Japanese market, you need the right documentation. Traditional Japanese resumes (Rirekisho) are very different from CVs in the US or Europe.

Learn more: How to Write a Japanese Resume (Rirekisho) & CV for Engineers

>[Free Template] Complete Guide to Japanese Resumes for IT Engineers

>[Free Template]Japanese CV Guide for Engineers: How to Write a Shokumu Keirekisho

Platform for Engineers: If you want to be scouted directly by tech companies without the hassle of traditional applications, use GitTap. It’s a platform designed specifically for engineers to find modern work environments in Japan.

>Sign up for GitTap and let companies come to you

Conclusion

The Japanese salary system is designed for stability and long-term rewards. While the deductions and "Minashi Zangyo" might seem strange at first, the total compensation—including health security and professional growth in a world-leading economy—makes Japan an incredible destination for engineers.

Ready to start your journey? Let GTalent guide you through the complexities of the Japanese market.